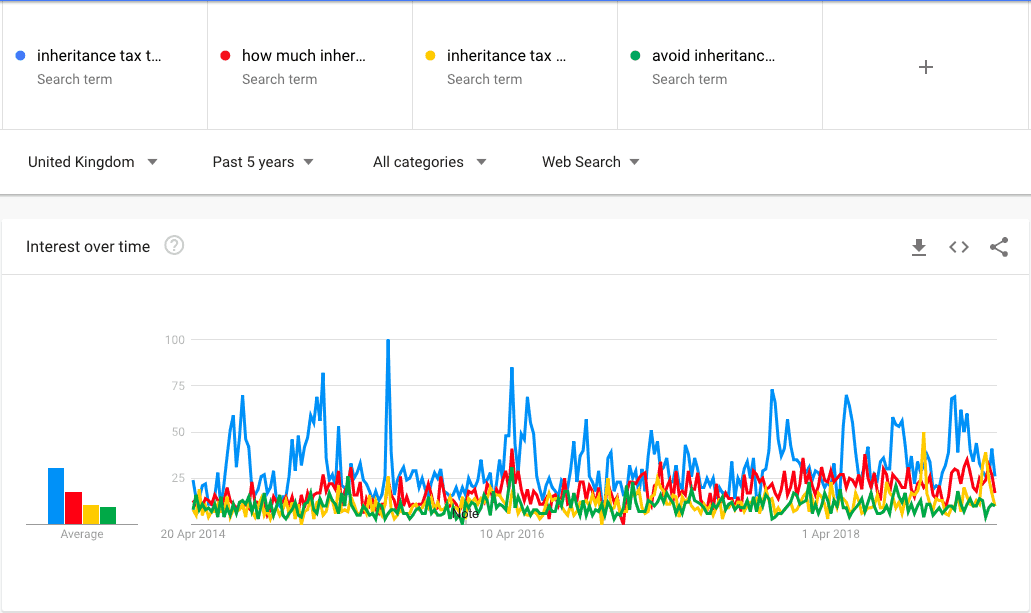

inheritance tax changes 2021 uk

In addition the residence nil-rate. This could be further.

Tax Day 2021 What Will Changes To Inheritance Tax And Tax Admin Mean For You Personal Finance Finance Express Co Uk

Your 2021 Tax Bracket To See Whats Been Adjusted.

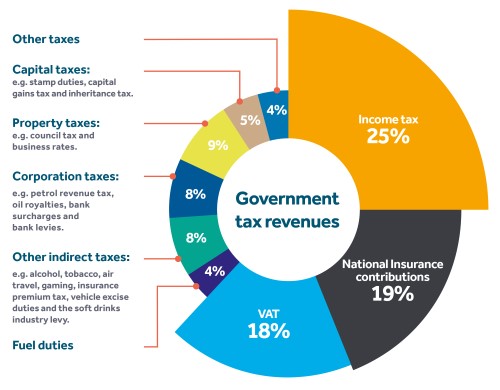

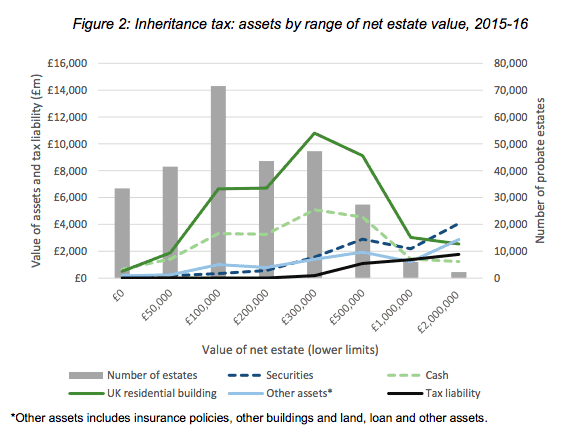

. This could result in a significant increase in CGT rates if this recommendation is implemented. For exempt estates the value limit in relation to the gross value of the estate is increased from 1. In the tax year 2019 to 2020 376 of UK deaths resulted in an Inheritance Tax IHT charge increasing slightly by 002 percentage points.

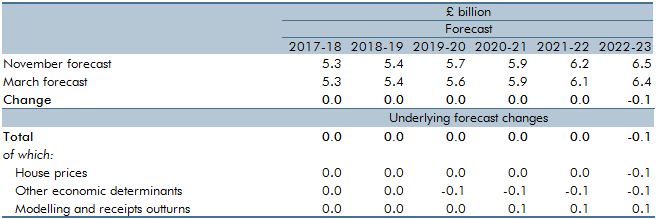

The Government is set to introduce legislation in Finance Bill 2021 so that the inheritance tax nil-rate bands will remain at existing levels until April 2026. For 2021-22 youll be charged at 10 on the first 1m of gains when selling a qualifying business the same as the 2020-21 tax year. The government has announced that the inheritance tax IHT threshold will remain frozen at 325000 until 20252026.

With the Chancellor announcing in the budget this year that the inheritance tax thresholds will be frozen. The limit for chargeable trust property is increased from 150000 to 250000. The key changes to the inheritance tax treatment of settlements are summarised below.

Where property is added to a settlement it. UK Inheritance Tax Rules The FAQs. The tax body stated.

This is called entrepreneurs relief. The person died on January 2 2022 leaving an estate worth 285000 which is below the inheritance tax threshold. On death it has been suggested that there will be no tax free uplift the donee inherits at the donors base cost.

For lifetime gifts there would be no capital gains tax on the. This measure introduces an additional nil-rate band when a residence is passed on death to a direct descendant. 100000 in 2017 to 2018.

Often referred to colloquially as death tax it is a levy that is placed. Clients In 50 Countries. The key points from this years publication are.

Tax rates and allowances. 125000 in 2018 to 2019. Ad Compare Your 2022 Tax Bracket vs.

Inheritance Tax or IHT is a complicated topic with many different factors clauses and conditions to bear in mind. The changes in tax rates could be as follows. Youve decided to leave your home to your children.

Ad Inheritance Guidance is Just One of the Benefits of Wealth Planning. This means no inheritance tax will be charged on the first 500000 325000 basic allowance 175000 main residence allowance. Make The World Your Marketplace With Aprios Intl Tax Planning Services.

Additions to a settlement. Ad Cross New Borders With Confidence. The first 325000 of your estate is tax-free so the 40 tax only applies to anything that goes over this value.

Taxes are never popular but Inheritance Tax IHT is arguably subject to more criticism than any other. INHERITANCE tax pensions and other financial considerations may be impacted by oncoming divorce law changes according to new analysis. The current UK IHT system is often perceived as unfair and unduly complex so a review of the system and subsequent report was welcomed by many.

See Whats Been Adjusted For Income Tax Brackets In 2022 vs. They left the estate to their daughter. Proposed changes to Capital Gains Tax.

If you leave your property to your children or your grandchildren including adopted. Budget 2021 - Changes to Inheritance Tax Posted on 29th April 2021 at 1236.

Will We See A Rise In Inheritance Tax Iht Or A New Wealth Tax

How To Avoid Inheritance Tax In 2022 And Save Your Family 140k

Uk Inheritance Tax Statistics Threshold Exemptions Patrick Cannon

Inheritance Tax To Be Affected By New Law Arriving In 2021 Will Grandparents Pay More Personal Finance Finance Express Co Uk

Will There Be Changes To Inheritance Tax Following Covid 19

Hmrc Tax Rates And Allowances For 2022 23 Simmons Simmons

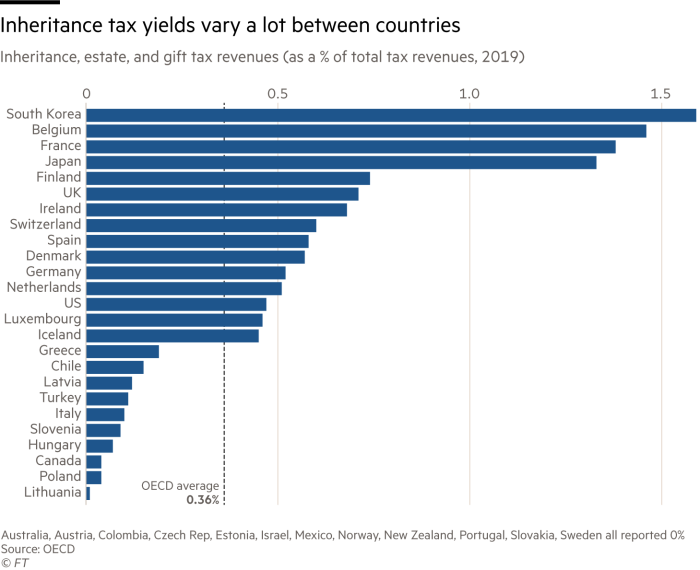

The Future Of Uk Inheritance Tax Lessons From Other Countries Financial Times

Estate And Inheritance Taxes Around The World Tax Foundation

Estate Taxes And Inheritance Taxes In Europe Tax Foundation

Post Covid 19 Tax Planning Be Prepared For Tax Rises Cgwm Uk

Inheritance Tax And Trusts Hmrc Registration Rules Change What Does This Mean For You Personal Finance Finance Express Co Uk

Uk Inheritance Tax Statistics Threshold Exemptions Patrick Cannon

How To Prepare For Potential Changes To Inheritance Tax Uk Everfair Tax

Iht Office For Budget Responsibility

Inheritance Tax Changes Chancellor Rishi Sunak Walking Tax Tightrope To Balance Budget Personal Finance Finance Express Co Uk

Uk Inheritance Tax Thresholds And Rates Saltus

Inheritance Tax Debate What The Wealthy Need To Know Financial Times

Inheritance Tax Receipts Uk 2022 Statista

How Inheritance Tax Works Thresholds Rules And Allowances Overview Gov Uk